Top Guidelines Of Personal Loans Canada

Wiki Article

10 Easy Facts About Personal Loans Canada Shown

Table of ContentsFascination About Personal Loans Canada4 Simple Techniques For Personal Loans CanadaThe Facts About Personal Loans Canada RevealedThe 15-Second Trick For Personal Loans CanadaSome Known Details About Personal Loans Canada

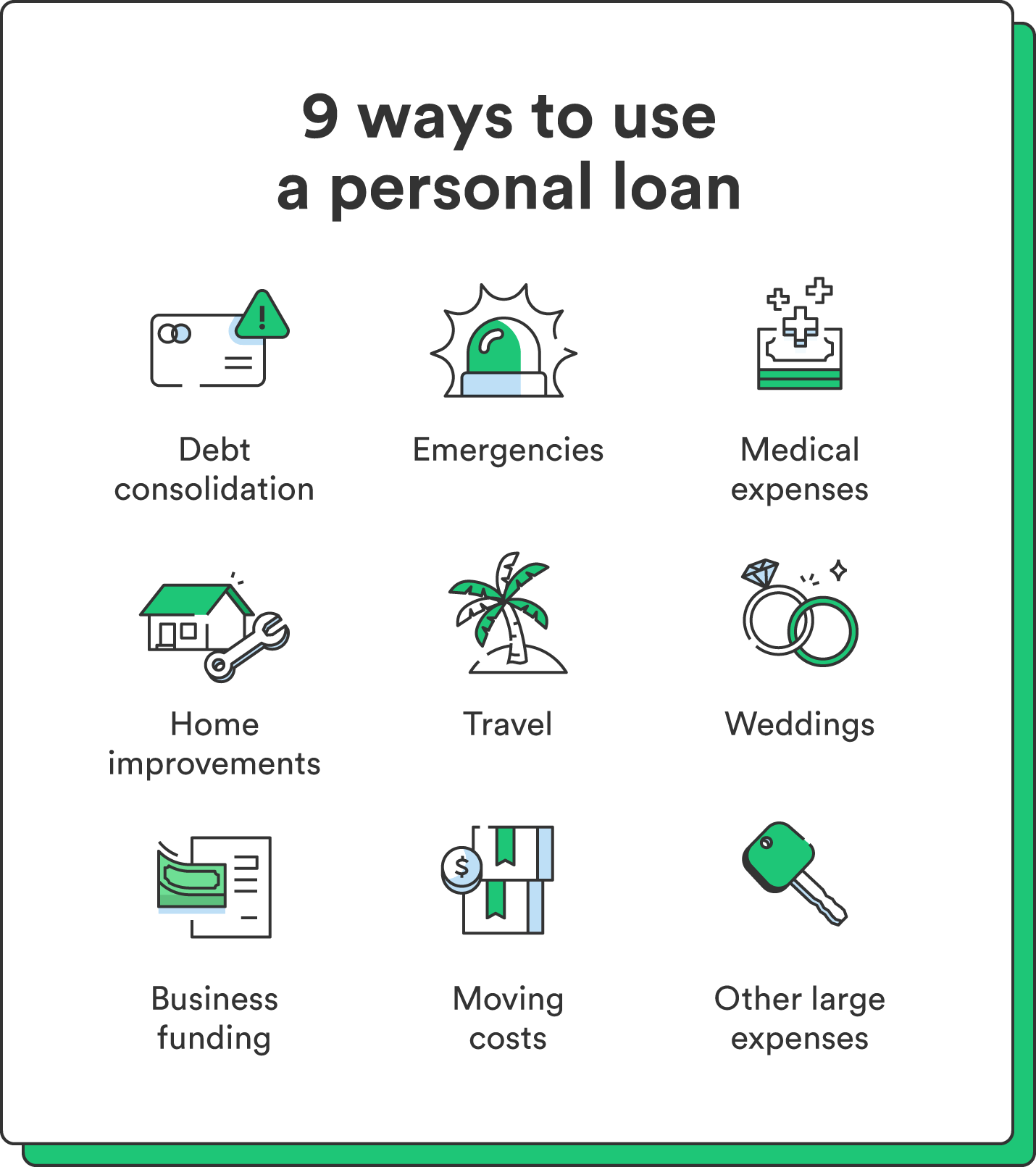

Let's study what an individual financing in fact is (and what it's not), the factors people use them, and just how you can cover those insane emergency situation costs without taking on the worry of financial debt. A personal lending is a lump amount of money you can borrow for. well, nearly anything.That does not include obtaining $1,000 from your Uncle John to assist you spend for Christmas presents or letting your flatmate area you for a couple months' rental fee. You shouldn't do either of those points (for a number of factors), but that's practically not a personal loan. Individual loans are made through a real financial institutionlike a financial institution, lending institution or on-line lender.

Allow's have a look at each so you can understand specifically just how they workand why you don't need one. Ever. A lot of individual lendings are unprotected, which suggests there's no security (something to back the lending, like an auto or house). Unsecured finances typically have higher rates of interest and call for a far better credit report due to the fact that there's no physical thing the lender can take away if you don't pay up.

An Unbiased View of Personal Loans Canada

Surprised? That's fine. No issue how good your credit report is, you'll still have to pay interest on most individual finances. There's always a price to spend for borrowing money. Guaranteed personal car loans, on the various other hand, have some type of collateral to "secure" the lending, like a watercraft, fashion jewelry or RVjust among others.You could likewise take out a safeguarded personal funding utilizing your car as collateral. Depend on us, there's absolutely nothing secure about safe financings.

Just because the repayments are predictable, it doesn't indicate this is an excellent bargain. Personal Loans Canada. Like we claimed in the past, you're practically guaranteed to pay interest on a personal lending. Just do the math: You'll end up paying method a lot more in the lengthy run by taking out a finance than if you would certainly simply paid with cash money

:max_bytes(150000):strip_icc()/Personal-loans-111715-final-3c39d6d214e44604bdc1efca2525d37d.png)

The Best Strategy To Use For Personal Loans Canada

And you're the fish holding on a line. An installment funding is an individual funding you repay in repaired installations with time (generally here as soon as a month) till it's paid completely - Personal Loans Canada. And do not miss this: You need to pay back the original car loan amount before you can obtain anything else

Don't be misinterpreted: This isn't the exact same as a credit report card. With personal lines of credit rating, you're paying passion on the loaneven if you pay on time.

This obtains us provoked up. Why? Due to the fact that these services take advantage of individuals who can not pay their bills. Which's just wrong. Technically, these are temporary fundings that give you your income beforehand. That might appear confident when you're in an economic wreck and require some cash to cover your bills.

Everything about Personal Loans Canada

Why? Due to the fact that points obtain actual unpleasant real fast when you miss a payment. Those creditors will come after your wonderful granny that guaranteed the lending for you. Oh, and you ought to never cosign a funding for any individual else either! Not just might you get stuck with a car loan that was never implied to be yours to begin with, but it'll mess up the connection before you can say "pay up." Trust us, you do not wish to get on either side of this sticky scenario.However all you're truly doing is using brand-new financial debt to settle old financial obligation (and extending your loan term). That simply implies you'll be paying a lot more gradually. Companies recognize that toowhich is precisely why many of them supply you loan consolidation financings. A lower interest price doesn't obtain you out of debtyou do.

And it begins with not borrowing anymore money. ever before. This is a good regulation of thumb for any type of financial purchase. Whether you're considering securing a personal financing to cover that kitchen area remodel or your frustrating bank card costs. don't. Taking out financial obligation to spend for things isn't the method to go.

An Unbiased View of Personal Loans Canada

The very best thing you can do for your financial future is leave that buy-now-pay-later state of mind and state no to visit this site those investing impulses. And if you're taking into consideration an individual car loan to cover an emergency, we get it. Obtaining cash to pay for an emergency only escalates the stress and hardship of the scenario.

Report this wiki page